Small Business Book Keeping Services

Your business deserves more than just spreadsheets and software. With Atidiv, you gain dedicated small business bookkeepers who handle daily financial tasks, integrate AI-enabled workflows, and free you to focus on strategic growth.

Why Your Small Business Needs Expert Bookkeeping

If you’re running a small business (such as a consumer brand with 3+ employees), you already wear many hats – operations, marketing, customer service, and product development, and your bookkeeping shouldn’t add to the burden. When you engage professional bookkeepers for small businesses, you gain clarity into your finances, ensure compliance, and generate timely insights that support decision-making.

By outsourcing to experienced specialists, you avoid the errors and time consuming tasks that drain your team’s focus. Backed by Atidiv’s 16+ years of operational excellence and a dedicated finance and accounting team with proven expertise, we ensure 100% accuracy through a three-stage quality check process so every transaction is precise and decision-ready.

What We Offer: Bookkeeping Services Built for You

Daily Transaction Processing

We manage your accounts receivable, accounts payable, cash flow classification, and expense tracking. Our team ensures each transaction is correctly recorded, reconciled, and ready for reporting.

Monthly Reconciliations and Reporting

Your dedicated bookkeepers for small businesses will perform monthly and quarterly reconciliations of all banking, credit card, and loan accounts. You will receive tailored financial statements and dashboards that provide clear insight into your performance.

AI Bookkeeping for Small Business

We leverage AI-enabled workflows alongside human oversight to accelerate processing, reduce manual error, and enable smarter categorization and anomaly detection. This hybrid model helps you benefit from automation while retaining the strategic insight of real professionals.

Scalable, Transparent Pricing

We understand budgets matter. Our bookkeeping prices for small businesses start from just US $15/hour, allowing you to scale without heavy upfront cost.

Process Setup and Continuous Improvement

We don’t just maintain books; we optimize them. Our team works with you to define the chart of accounts, integrate your software stack, and continuously improve processes to support growth.

Advisory and Integration

As part of our comprehensive approach, we offer monthly review meetings, variance analysis, cash flow forecasting, and budgeting support, so you have a trusted partner, not just data. Even as you focus on operations, we’re helping you steer strategy.

How It Works: Simple, Seamless, Effective

Onboard

We review your current bookkeeping setup, identify gaps, and align on goals.

Onboard

We review your current bookkeeping setup, identify gaps, and align on goals.

Transition

Bookkeepers for small businesses from Atidiv take over daily tasks, standardize charts of accounts, implement automation and integrate systems.

Transition

Bookkeepers for small businesses from Atidiv take over daily tasks, standardize charts of accounts, implement automation and integrate systems.

Operate and Optimize

We deliver monthly closes, dashboards, insights, and continuously refine processes.

Operate and Optimize

We deliver monthly closes, dashboards, insights, and continuously refine processes.

Scale

As your business grows, our model scales with you, adding new entities, markets, or complexity without disruption.

Scale

As your business grows, our model scales with you, adding new entities, markets, or complexity without disruption.

Bookkeeping Prices for Small Business: What to Expect

Hourly support

Starting at US $15/hour, ideal for routine bookkeeping, smaller transaction volumes, or seasonal support.

Monthly retainer

Fixed monthly fee for full or part-time bookkeeping based on volume, entities, and complexity.

Project-based engagement

Clean-up, migration, software setup or backlog resolution as discrete tasks.

Why Choose Atidiv as Your Small Business Bookkeeping Partner?

With 16+ years of finance and accounting experience, we support startups and growth-stage businesses across 20+ industries.

Our three-stage quality check framework and 95% client retention rate underscore our commitment to accuracy and service excellence.

Whether you need part-time bookkeeping or full monthly close support, our pricing model aligns with your business reality.

Our blend of AI bookkeeping for small businesses and human oversight ensures speed, accuracy, and scalability.

We treat your books not just as records, but as strategic tools. As you grow, we evolve with you.

We seamlessly integrate with any Platform

Features included across plans

Features included across plans: transaction processing, reconciliations, financial statement preparation, dashboard reporting, AI-enabled classification, and unlimited monthly review meetings. Higher tiers scale with multi-entity support, forecasting, and advisory.

If you’re ready to transform your bookkeeping from a monthly chore into a strategic advantage, we’re here to help. Partnering with Atidiv means entrusting your financial foundation to professionals who care about accuracy, insight, and your growth

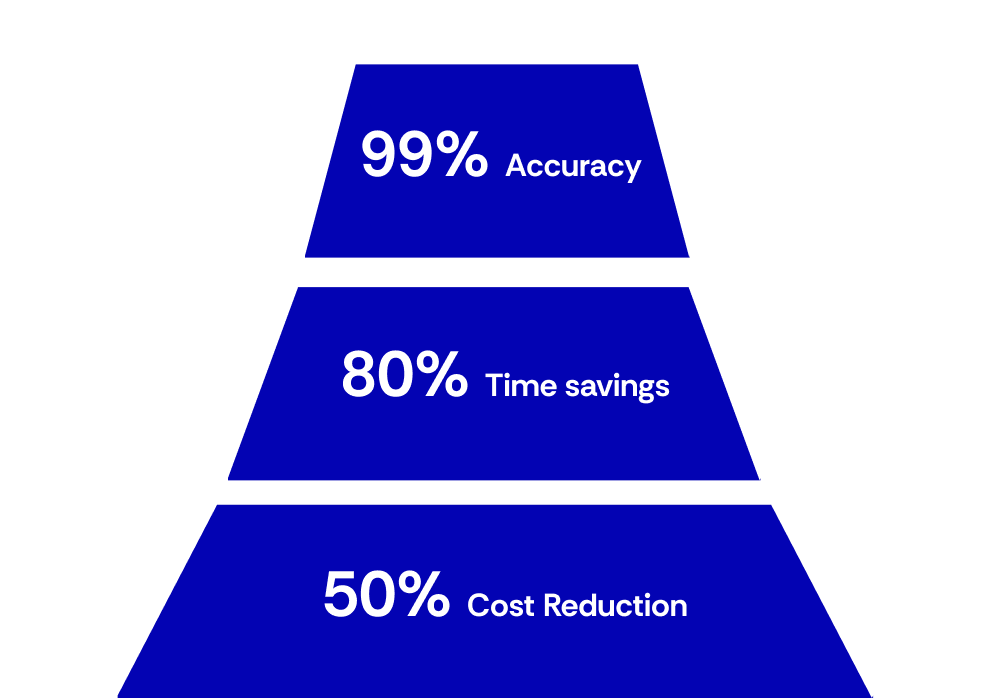

Case Study: Transforming Bookkeeping with Automation

Challenge

Delayed monthly closure, poor bookkeeping accuracy, and lack of inventory accounting led to inefficiencies and reporting delays.

Solution

Delayed monthly closure, poor bookkeeping accuracy, and lack of inventory accounting led to inefficiencies and reporting delays.

“Every business is unique — get a proposal tailored to you.”

Bookkeeping Services For Small Business FAQs

Hiring bookkeepers for small businesses through a partner like us gives you experienced, specialised support at a fraction of the cost of an in-house hire. You avoid salary, benefits, recruitment, training, and turnover risk.

We maintain strict data-protection protocols, secure cloud platforms, and controlled access. Your financial records are handled responsibly with strong governance, ensuring accuracy, confidentiality, and audit-readiness.

We serve businesses across start-up and growth stages. If you have ongoing sales, expenses, invoices and bank transactions and need monthly reporting and reconciliations, our services apply. Let’s discuss your specific volume to determine the right plan.

We use AI-enabled algorithms to classify transactions, flag anomalies, optimise workflows and accelerate recurring tasks. Bookkeepers then review and validate outputs, delivering both speed and accuracy.

After onboarding and system setup, many clients see full operations within 2–4 weeks. Clean-up of prior months may extend timelines depending on backlog and complexity.

Our model is designed for scale. We onboard additional entities, integrate software, standardise processes, and adjust scope and pricing accordingly so bookkeeping remains efficient and proactive.

Outsourcing removes the fixed costs of full-time employees, infrastructure, benefits and management overhead. You pay for service, not employment. That means you gain expert bookkeepers for small businesses at a more efficient cost.