Startup Accounting Services

Comprehensive accounting solutions for startups — from AI-driven bookkeeping and CPA support to outsourced accounting, payroll, and financial software integration.

Startup Accounting Services for Growing Businesses

As you build and scale your business, the right finance partner is essential. At Atidiv, we specialize in startup accounting services designed specifically for fast-moving companies like yours. Whether you are just getting started or expanding rapidly, we provide the expertise, tools, and infrastructure needed to manage your numbers, free your team, and support your growth.

Why You Need A Specialized Accounting Service for Startups

Running a startup means balancing innovation, speed, and financial discipline. You face unique challenges: managing rapid cash flow changes, meeting investor expectations, and staying audit-ready. Generic accounting firms often apply a one-size-fits-all approach, lacking the flexibility and startup-centric mindset you require.

That’s where a true accounting service for startups makes a difference. You gain:

- A team that understands the startup life-cycle: Fundraising, burn-rate management, recurring revenue models, and scaling cost structures.

- A system built for growth: Standardized bookkeeping, scalable processes, and reliable monthly financials.

- A partner who takes care of the accounting so you can focus on product, customers, and market fit.

Atidiv’s outsourcing model is built to serve those needs. We handle end-to-end finance and accounting at every stage so that you can focus on growth. Additionally, our accounting services for tech startup companies are designed to handle fast-moving digital environments, SaaS revenue models, and evolving compliance needs without slowing innovation.

What Atidiv Offers: A Full-Spectrum Solution

Foundational Bookkeeping and Accounting Operations

Startups need a clean, reliable foundation. Our team supports transaction processing, bank reconciliations, bookkeeping, and monthly close processes. This base is critical for all further financial work and ensures that you are operating on reliable data.

Outsource Accounts-Payable Services for Startups

As your vendor base expands and your payment cycles tighten, managing payable workflows can become a burden. Atidiv’s outsourcing of accounts payable ensures your vendor payments, expense controls, and cash flow timing are handled professionally, reducing manual burden and error risk.

Financial Reporting, Metrics, and Dashboards

Beyond bookkeeping, you’ll receive timely financial reporting: profit and loss statements, balance sheets, cash flow summaries, and metrics tailored to your business. This enables informed decision-making and supports investor readiness.

Tax, Compliance, and Audit Readiness

With growth comes complexity: multistate tax obligations, regulatory filings, and audit expectations. Atidiv supports you in strategic planning, budgeting, and reporting, allowing you to stay compliant and audit-ready while you scale.

Fractional CFO and strategic advisory support

You might not need a full-time CFO just yet, but you still need strategic financial leadership. Atidiv embeds expert teams that act as an extension of your business, helping with budgeting, forecasting, fundraising support, and scenario modeling. Our experienced professionals operate with the precision and oversight you’d expect from a startup CPA, ensuring compliance, clarity, and confidence in every financial decision.

Technology-Enabled Infrastructure and Startup Accounting Software

Atidiv emphasizes the use of modern tools, real-time analytics, and tight quality control. We help you select and implement the best accounting software for startups and embed it into your operations. The right startup accounting software enables scalability, integration, and audit readiness. As the landscape of AI startup revenue quality in 2025 continues to evolve, Atidiv’s data-driven accounting framework ensures your revenue recognition, analytics, and reporting remain investor-grade and audit-ready. When you outsource accounting services for startups to us, you gain a seamless extension of your finance function, combining automation, process discipline, and industry expertise.

Why Atidiv is the Right Partner for You

Outsourcing-First Model

: Atidiv offers embedded expert teams and outsourcing services, meaning you don’t need to hire, train, and manage a large internal finance team.

Outsourcing-First Model

: Atidiv offers embedded expert teams and outsourcing services, meaning you don’t need to hire, train, and manage a large internal finance team.

Startup-Friendly Mindset

You’re not simply a small business; you’re scaling, moving fast, and need a partner who keeps up.

Startup-Friendly Mindset

You’re not simply a small business; you’re scaling, moving fast, and need a partner who keeps up.

Scalable Service Delivery

As you grow, expand into new territories, or add entities, Atidiv can scale with you.

Scalable Service Delivery

As you grow, expand into new territories, or add entities, Atidiv can scale with you.

Technology and Process Excellence

With emphasis on real-time analytics and quality control, you gain reliable operations that support scale.

Technology and Process Excellence

With emphasis on real-time analytics and quality control, you gain reliable operations that support scale.

Cost-Effective Delivery

Outsourcing allows you to access senior-level expertise and robust systems without the full cost of in-house infrastructure or a large team. With Atidiv, you retain the focus on product, market, and growth, while we manage the accounting operations, controls, and reporting.

Cost-Effective Delivery

Outsourcing allows you to access senior-level expertise and robust systems without the full cost of in-house infrastructure or a large team. With Atidiv, you retain the focus on product, market, and growth, while we manage the accounting operations, controls, and reporting.

Why You Need A Specialized Accounting Service for Startups

Running a startup means balancing innovation, speed, and financial discipline. You face unique challenges: managing rapid cash flow changes, meeting investor expectations, and staying audit-ready. Generic accounting firms often apply a one-size-fits-all approach, lacking the flexibility and startup-centric mindset you require.

Atidiv’s outsourcing model is built to serve those needs. We handle end-to-end finance and accounting at every stage so that you can focus on growth. Additionally, our accounting services for tech startup companies are designed to handle fast-moving digital environments, SaaS revenue models, and evolving compliance needs without slowing innovation

Bookkeeping Prices for Small Business: What to Expect

“Fuel your next growth stage with our startup accounting expertise.”

Fundraising, burn-rate management, recurring revenue models, and scaling cost structures.

A system built for growth

Standardized bookkeeping, scalable processes, and reliable monthly financials.

Your Accounting Partner for Focused Growth

A partner who takes care of the accounting so you can focus on product, customers, and market fit

Common Startup Accounting Challenges and How We Address Them

We deliver monthly models, burn-rate tracking, and scenario planning so you know where you stand.

Our outsourced accounts payable services for startups streamline vendor set-up, approvals, payment scheduling, and integration into your finance workflows.

You gain access to fractional CFO support, investor-ready reporting, scenario modeling, and strategic planning.

We help select and implement the right accounting tool, integrate transaction flows, and align processes for growth.

By outsourcing with Atidiv, you tap into senior expertise when required and scale flexibly as your business matures, without prematurely hiring a large internal team.

By choosing outsourced accounting for startups, you unlock expert financial operations that scale as fast as your company. If you are seeking outsourced accounting services for startups that deliver more than basic bookkeeping, Atidiv stands ready to partner with you. Our approach is designed for high-growth companies: tech-driven, ambitious, and focused on scaling. With our finance and accounting infrastructure as your backbone, you gain clarity, control, and capacity to grow.

Contact us to discover how our specialized startup accounting firm model can fuel your next stage of growth.

We seamlessly integrate with any Platform

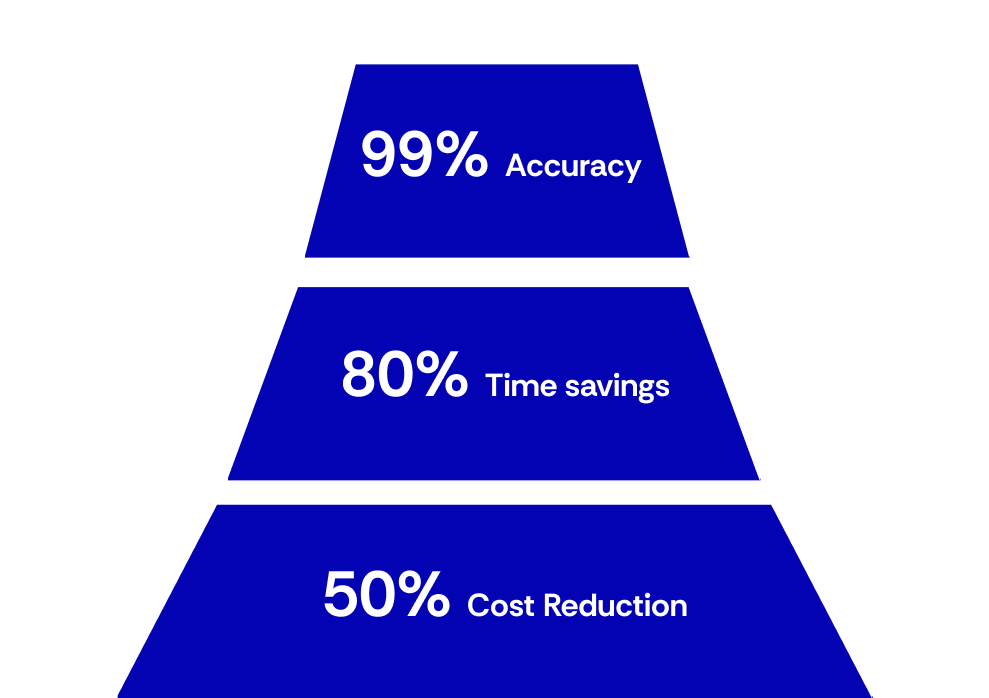

The Benefits You Will Realize

Time freed up

Better insight

Investor confidence

Scalable foundation

Reduced risk

Cost efficiency

Case Study: Transforming Bookkeeping with Automation

Challenge

Delayed monthly closure, poor bookkeeping accuracy, and lack of inventory accounting led to inefficiencies and reporting delays.

Solution

Delayed monthly closure, poor bookkeeping accuracy, and lack of inventory accounting led to inefficiencies and reporting delays.

“Discover how our specialized startup accounting model can power your next stage of growth.”

FAQs on Startup Accounting Services

You should consider engaging a startup accounting service when you are accumulating significant transactions, raising your first funding round, spending excessive time on manual accounting work, or lacking clarity on your runway and burn rate.

The accounting service for startups typically includes bookkeeping, transaction processing, monthly close, vendor payable/receivable oversight, financial reporting, KPI dashboards, tax and compliance support, and strategic advisory through fractional CFO-level engagement.

You must look for a partner with experience servicing startups and growth-stage companies, a technology-enabled delivery model, scalable processes, integration capability, and an understanding of startup metrics, funding rounds, and growth dynamics.

Outsourcing gives you access to experienced teams, systems, and processes without bearing the full cost and overhead of building an internal finance department. It offers flexibility and speed of scale, and allows you to remain focused on your core business.

Yes. Our service includes evaluating, recommending, and integrating the best accounting software for startups suited to your business model, ensuring it ties into your transaction flows and supports scale.

We provide fractional CFO-level advisory, scenario modeling, financial forecasting, budget development, and investor-ready reporting. With this support, you are better equipped for fundraising, growth decisions, and board discussion.