Customer churn represents the number of customers who stop using your company’s products or services. Usually, this happens for many reasons, such as dissatisfaction, better offers from competitors, or changing needs.

For growing consumer brands, especially in the US, UK & Australia, understanding churn is necessary. Whether you’re a VP of Customer Experience, a Director of Customer Support, or a senior making a retention strategy, churn directly impacts long-term revenue growth.

Does your business rely on subscriptions, or do you own a software-as-a-service (SaaS) company? If you make money from customers who pay every month, tracking customer churn is highly important for you.

It allows you to predict when customers might leave so that you can take necessary action to keep them. For example: D2C companies with over $5M in revenue use churn analysis to identify weak points in onboarding or customer support. To prevent revenue loss, you should check your churn rate regularly.

Want to know more? In this article, let’s check out the definition of customer churn, its causes, and impact on your business. Also, we will learn how you can measure customer churn and identify it.

What is Customer Churn?

Customer churn refers to the percentage of customers who stop doing business with your company (in a specific period). This means they either switch to a competitor or simply stop using your product or service without choosing an alternative.

For example, say you run a subscription-based business and have 1,000 customers at the start of the month. However, you lost 50 customers by the end. Now, your churn rate for that month would be 5% (50 ÷ 1000 x 100).

Industry benchmarks show that maintaining churn below 5% per month is ideal, but even a small increase can impact revenue for B2C and D2C brands. Thus, reducing churn is an important goal for every business. And, the best way to do this is through strong customer engagement.

Engagement includes every way a customer interacts with a company, such as:

- Visiting a website

- Talking to customer support

- Shopping in a store

Furthermore, by developing a strong customer retention plan, you can keep your customers satisfied and loyal.

How to Measure Customer Churn?

The most common way to measure churn is by using the churn rate formula:

Churn Rate = (Number of Customers Lost ÷ Total Customers at the Start of the Period) x 100

Another approach is the abandonment rate, which is:

Abandonment Rate = 100% – Retention Rate

To fully understand churn, you should track it from two angles:

- Customer Churn: The actual number of customers leaving your business.

- Revenue Churn: The amount of money lost due to customer departures.

For leaders in customer experience, focusing only on customer count can be misleading. Revenue churn highlights if you’re losing high-value accounts, which hurts more than volume-based losses.

By monitoring both, you can understand whether you’re losing small or high-value customers. This allows you to take the right actions to reduce customer churn and grow your business.

What are the Causes of Customer Churn?

As a business owner, your focus might be on getting new customers through marketing. However, before spending money on expansion, it’s wise to first analyze your current customers’ satisfaction.

That’s because keeping existing customers is often cheaper and more effective than constantly acquiring new ones. As per a Bain & Company study, increasing customer retention by 5% can increase profits by 25–95%.

So, what causes customers to leave? Let’s check out some main reasons:

1. Customer Dissatisfaction

If customers are unhappy with your product/service or customer support, they are likely to leave. These issues can push them to competitors:

- Poor quality

- Late deliveries

- Unresolved complaints

2. Better Offers from Competitors

If another company offers similar products at a lower price (or with better features), customers may switch.

3. Competitors’ Successful Marketing

Competitors can attract your customers by:

- Launching aggressive marketing campaigns

- Offering discounts or exclusive deals

For CX leaders, monitoring reasons for churn through Voice of Customer (VoC) programs and feedback is important for staying ahead of competitors.

How Does Customer Churn Affect Your Business?

B2C companies (like streaming services or online shopping) usually have higher churn rates because customers can easily start or stop using their services.

In contrast, B2B companies feel a stronger impact from churn. Losing even one account can cause major revenue loss because sales cycles are long and acquisition costs are higher.

For mid-market D2C brands, churn decreases growth. Many find that improving customer experience and service delivery is the fastest way to protect margins.

Reduced Company Morale

High churn also affects company morale. If too many customers leave, employees may worry about job security and the company’s future.

Bad Marketing

Unhappy customers sharing negative reviews can amplify churn through poor word of mouth.

How to Identify Customer Churn?

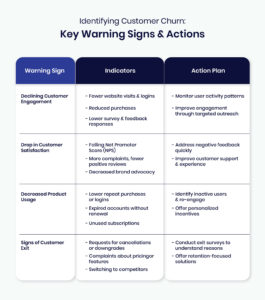

Below are four warning signs that indicate a higher risk of losing customers:

- Low Customer Engagement – Drop in purchases, survey responses, or NPS.

- Declining Customer Satisfaction – Measured via NPS, CSAT, and customer feedback.

- Decreased Product Use – Lower login frequency, expired accounts, or frequent complaints.

- Direct Signals of Leaving – Customers requesting downgrades or showing pricing concerns.

CX leaders use predictive analytics and customer success strategies to act before churn happens.

Reduce Customer Churn, Boost Retentions with Atidiv

Customer churn is a critical challenge for businesses. It affects your revenue and brand reputation. To reduce churn, you should:

- Understand why customers leave

- Measure churn rates regularly

- Engage with your customers and address dissatisfaction

- Stay competitive with pricing and features

- Track customer behavior and identify warning signs early

Atidiv partners with D2C and consumer brands to design CX programs that reduce churn and improve customer lifetime value. Whether you’re a VP, Director or Sr. Manager of Customer Experience, our solutions help you retain high-value customers and accelerate growth.

Partner with Atidiv today and take control of your customer retention strategy.

FAQs On Customer Churn

1. How can I quickly reduce customer churn in my business?

To reduce customer churn, focus on improving customer experience. You can start by identifying why customers leave (through feedback surveys). Next, engage with them via outsourced email services or support channels and offer personalised discounts or upgrades.

Try to ensure your product quality is consistent and competitive. By providing excellent customer service, you can also encourage customers to stay.

2. What is a good customer churn rate for my business?

A good churn rate varies by industry, but for most subscription-based businesses, a rate below 5% per month is ideal. Be aware that lower churn means higher customer retention. It leads to steady revenue.

3. How do I know if my customers are about to leave?

Watch for warning signs such as:

- Reduced product usage

- Negative feedback

- Increased complaints

- Inactivity

A drop in login frequency or purchases also indicates disengagement. By regularly tracking these metrics, you can reach out to at-risk customers before they leave.

4. Should I focus on getting new customers or retaining existing ones?

Retaining existing customers is more cost-effective than acquiring new ones. Studies show that increasing retention by 5% can boost profits by 25-95%. Loyal customers also promote your brand and provide repeat business.

However, you should still balance retention with new customer acquisition for steady growth.

5. What strategies can I use to prevent customers from switching to competitors?

You can offer:

- Competitive pricing

- Superior customer service

- Exclusive benefits

Also, personalise your marketing to make customers feel valued. Most importantly, keep improving your product or service based on customer feedback.