Customer Lifetime Value (CLTV) is the total revenue a business earns from a customer throughout their relationship. It directly links to customer retention, as higher retention means customers stay longer and spend more. By implementing customer retention strategies, you can increase CLTV and maximise profits.

It is always easier to sell more to your current customers than to find new ones. Studies show that businesses have a 60–70% chance of selling to existing customers, compared to only 13–20% for new prospects.

Doesn’t this instantly increase the value of your existing customers? Now, what if they stop buying? If this happens, your business loses money. Besides a fall in revenue, such instances also negatively impact your brand reputation.

One way to resolve this is by tracking Customer Lifetime Value (CLTV). It shows you how much money a customer brings to your business over time. By focusing on customers who stay longer and spend more, you can increase profits without always chasing new buyers.

For CX leaders and directors at consumer brands in the US, UK & Australia with $5M+ revenue, improving CLTV is a key way to build sustainable growth and keep acquisition costs in check.

What is Customer Lifetime Value?

Customer Lifetime Value (CLTV) is the total amount of money a customer is expected to spend during the entire course of their relationship with your brand. It helps you understand how valuable each customer is. By tracking CLTV regularly, you can increase customer retention.

To calculate CLTV, you have to consider:

- How much do customers pay?

- How often do they buy?

- How long do they stay with your business?

It also includes costs like marketing, production, and daily operations. Mathematically, we represent it as follows:

Customer Lifetime Value (CLTV) = Lifetime Value × Profit Margin

Where,

Lifetime Value = Average Value of Sales × No. of Transactions × Retention Period

How to Calculate Customer Lifetime Value (CLTV)?

CLTV is directly related to customer retention. Using it, you can identify the best customers who bring you the most revenue. You can calculate CLTV using these steps:

- Average Purchase Value: Find this by dividing your total revenue by the total number of purchases in a given period.

- Average Purchase Frequency: This is how often a customer buys from you in that time.

- Customer Value: Multiply the average purchase value by the purchase frequency.

- Average Customer Lifespan: This is the average number of years a customer keeps buying from you.

- LTV Formula: Multiply the customer value by the average customer lifespan.

For more clarity, let’s study a hypothetical example:

Let’s say you own a SaaS company that provides cloud storage services. You charge customers Rs. 1,000 per month for a subscription. On average, a customer stays subscribed for 24 months (2 years). Your Lifetime Value = Rs. 1,000 × 24 = Rs. 24,000

Now, let’s say your profit margin is 40%. So, your CLTV would be Rs. 1,000 × 24 × 40% = Rs. 9,600.

D2C companies in sectors like fashion, beauty, or consumer electronics can use the same approach to measure if repeat buyers contribute to growth or are churn decreasing profitability.

What Factors Impact CLTV?

CLTV depends on how long customers stay with your business and how much they spend. If customers easily switch to competitors, CLTV drops. Below are two key factors that influence CLTV:

1. Churn Rate

Churn rate means the number of customers who stop using your product or service. It has an inverse relationship with customer retention rate. A high churn rate means several of your existing customers leave. This significantly lowers your revenue.

Small businesses and startups often struggle with this because they face strong competition and customers don’t yet trust their brand. To reduce churn and increase client retention, you should focus on:

- Improving customer service

- Offering discounts for long-term plans

- Providing a great user experience

For senior CX managers in consumer brands, monitoring churn at a micro level is important to spot risks early and protect revenue.

2. Brand Loyalty

instead of switching to competitors. When customers are loyal, they stay longer. This increases your CLTV.

You can build loyalty and increase customer retention by:

- Offering excellent service

- Rewarding long-term customers

- Maintaining good communication

Global D2C brands with revenues above $5M+ invest in loyalty programs and customer journeys to protect lifetime value across markets like the US, UK & Australia.

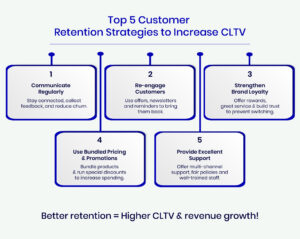

Top 5 Customer Retention Strategies to Increase CLTV

To increase CLTV, you should focus on keeping customers happy and engaged. This will make them stay longer and spend more. There are five ways to do it:

- Keep Communicating With Your Customers

Talking to your customers regularly builds trust. It strengthens their connection with your brand and improves customer retention. To do so, you should regularly ask for feedback and use it to improve your services. - Re-engage Customers

Stay in touch with past customers through:

- Special offers

- Newsletters

Reminders about your services

For D2C consumer brands, re-engagement campaigns are useful during seasonal dips when purchase frequency declines.

3. Increase Brand Loyalty

- Loyal customers stay longer and spend more. You can build loyalty and increase customer retention by offering:

- Rewards

- Excellent customer service

Great product experience

4. Consider Bundled Pricing and Promotions

A great way to increase customer spending and loyalty is by offering:

- Bundled pricing

- Targeted promotions

Bundling means combining related products at a discounted price. This makes customers buy more, which directly increases CLTV. For example, a SaaS company offers project management software. Now, it can bundle the product with a team collaboration tool at a lower price than buying separately.

On the other hand, targeted promotions (like special discounts for returning customers) again encourage them to spend more. Here, you can track customer retention and repeat purchases to measure success.

Please note that even small increases in order value over time significantly boost revenue and customer lifetime value. This lets you enjoy long-term business growth.

Consumer brands with 5M+ revenue often see CLTV growth by combining bundles with pricing models, specifically in competitive industries like retail and wellness.

5. Offer Good Customer Service

By providing excellent customer service, you can increase CLTV and customer retention. It keeps customers happy and encourages them to stay with your business for a long time. When customers feel valued, they are more likely to return and spend more.

To improve customer service, you should:

- Opt for omni-channel support options like phone, email, live chat, and social media. This allows customers to easily connect with you.

- Develop a fair return and refund policy. It builds trust and makes customers feel secure.

- Train employees in communication, problem-solving, and product knowledge.

- Collect customer feedback and use it to resolve issues.

Always remember that better service leads to higher customer satisfaction. This reduces churn and boosts your long-term revenue.

How Atidiv Can Help?

Atidiv specialises in increasing CLTV through innovative and data-driven CX outsourcing solutions. We partner with VPs, Directors and senior CX leaders in US, UK & Australia-based D2C companies to help them reduce churn, build loyalty, and growth.

- Higher Customer Experience

We provide personalised, omnichannel support (phone, email service outsourcing, chat, social) with a CSAT score of 4.8. This improves engagement and strengthens retention. - Data-Driven Insights

By tracking buying behaviour, preferences, and feedback, our analytics give CX leaders insights to design loyalty programs and predict churn. - Cost Efficiency

We save businesses up to 60% on customer support costs, allowing D2C brands with $5M+ revenue to reinvest in growth initiatives like retention campaigns and loyalty rewards.

Proven Success Stories

For example, we helped a US-based online tire retailer save $1.3 million while improving support quality, boosting both retention and CLTV.

Boost Your CLTV and Customer Retention with Atidiv!

Customer Lifetime Value (CLTV) is a key factor in building a successful business. For CX leaders managing consumer brands, improving CLTV drives revenue and reduces dependence on costly acquisition campaigns.

Want to engage your customers and boost CLTV? Choose Atidiv and our expert customer experience solutions. Partner with us to deliver scalable, data-driven support tailored for D2C growth.

FAQs On Customer Retention Value

1. Why is my CLTV low despite having many customers?

A low CLTV usually means customers don’t stay long or spend enough. Usually, this happens due to:

- Poor service

- High churn

- Strong competition

To resolve these issues, you should focus on customer retention, improve support services, and offer loyalty programs. You can also use targeted promotions to encourage repeat purchases.

2. How can I reduce my customer churn rate?

To reduce customer churn, you must:

- Offer excellent support

- Respond quickly to issues

- Personalise interactions.

Additionally, keep your customers interested through loyalty rewards and special offers. When customers feel valued, they stay longer. This increases both your CLTV and revenue.

3. What’s the best way to increase repeat purchases?

Some of the best ways to increase repeat purchases are:

- Offering discounts

- Bundled pricing

- Subscription plans

- Exclusive deals

Also, stay in touch with customers through personalised emails and follow-ups. Remember that a great product experience and strong brand loyalty always make customers return. This gradually increases customer retention and CLTV.

4. How can I measure if my customer retention strategies are working?

You can track several key metrics like:

- Repeat purchase rate

- Churn rate

- Customer satisfaction scores

Compare past and present CLTV values to see if customer retention efforts are successful. If numbers improve, your strategies are working. If not, refine your approach by analysing customer feedback.

5. How does outsourcing customer support improve CLTV?

When you outsource to leading agencies, like Atidiv, your customers receive professional and round-the-clock support. This allows you to resolve customer issues faster, which builds trust. Mostly, it leads to better customer retention and higher CLT.